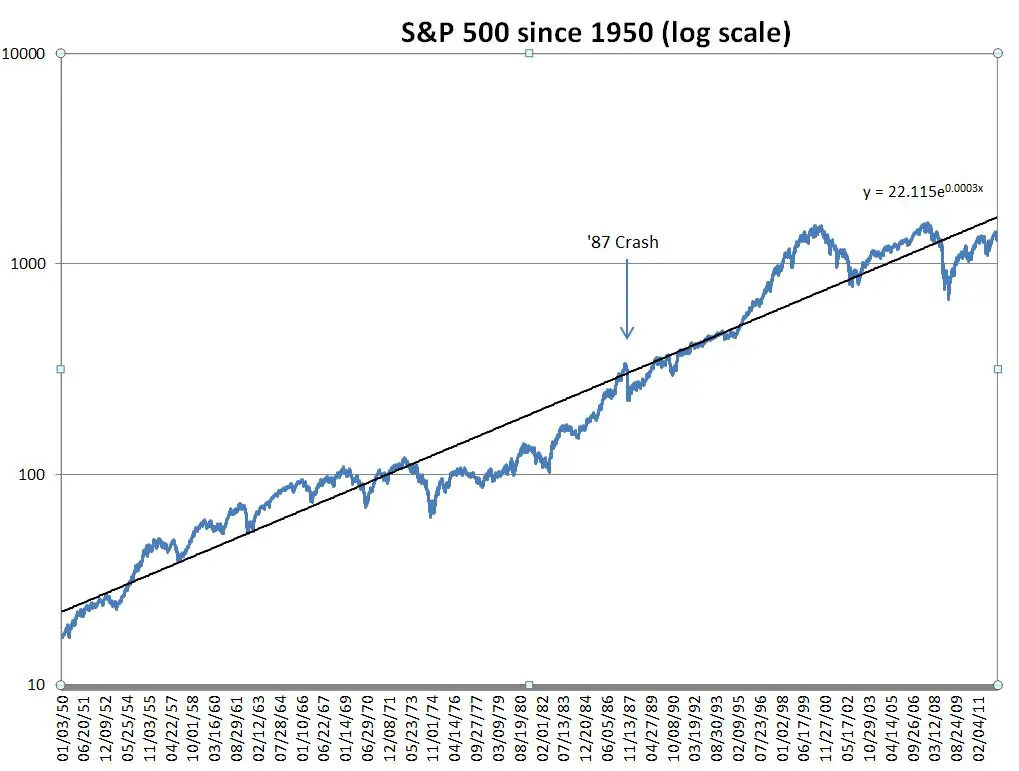

S&p 500 10 Year Chart

That mediocre long-term return could destroy 60/40 portfolios in the years ahead.

My biggest pet peeve as a professional investor is watching “urban investment legends” develop over time, flourish, and then wreck the wealth of people who are lulled into complacency by them. One such legend is that the S&P 500 Index always produces excellent long-term returns. By extension, investment pros and media suggest that you put most of your money into un-hedged equity investments, with a lesser piece in bonds and cash, just to “balance” things somewhat. I think this is the great advice…for the advisor, not for the client. Yet 60/40 portfolios, index funds and the like are now dominant portions of investors’ long-term portfolios.

As with anything in investing, this might work out. But I don’t think it will. And there are 2 reasons for that. First, the bond portion of the plan is fraught with risks we have not seen in nearly 40 years, thanks to a bond bear market that is now over 2 years old. Second, the S&P 500 Index has just shown that when you truly look over longer time periods…20 years, let’s say… the impact of the occasional but inevitable bear market crushes your expectations. And all of this assumes that you don’t ding your return with emotional decisions along the way.

Most stock quote data provided by BATS. Market indices are shown in real time, except for the DJIA, which is delayed by two minutes. All times are ET. S&P 500 Annual Total Return is at -4.38%, compared to 21.83% last year. This is lower. 5d; 1m; 3m; 6m; YTD; 1y; 5y; 10y; Max. Export Data Save Image Print Image. For advanced charting, view our full-featured Fundamental Chart. 'S' is commonly used at the end of a message to represent sex. Similar to 'X' in the UK (kisses) and 'Xs and Os' (kisses and hugs) in North America, 'S' could be used between two people of the same sex without being regarded as homosexual. Usually more Ss means more intense sexual tension between the two parties.

What do you think is the annualized return of the S&P 500 (including dividends) over the past 20 years? 8% 10%? Unduh microsoft office 2010. 15%? Try 4.5%. Really. Here’s the chart.

But that’s not the biggest urban investment legend in this chart. Take a look across the entire chart, which is 20-year rolling returns going back to the early 1970s…which means it covers every 20-year period for the U.S. stock market going back to a start date of around 1950. That is plenty of evidence from which to draw a conclusion. And what I see is that for the vast majority of this long time period, the 20-year annualized return was under 8%. And as for the current level of 4.5%? It is at the low end of normal, which I would define as between 4% and 8%. That is certainly a decent return on your invested capital. But it is not anywhere near what many unsuspecting investors have built into their assumptions about their financial future. This is the complacency I referenced earlier.

This distortion between real and fake news, so to speak, is primarily because today’s wealthiest investors remember the 1980s and 1990s, which were a period of nearly uninterrupted strong returns for stocks. Indeed, for most of the 1990s and last decade, the 20-year S&P 500 return was over 8%, and for a while it was way over that level.

But today’s investment climate is different. We are 9 years into a bull market for this revered index, and even that has only lifted the 20-year return to 4.5%. That tells you that the preceding decade was a rough time. It also tells you to start thinking about how to reduce your risk of disappointment by thinking beyond the buy-and-hold index fund, particularly that which tracks the S&P 500. And when you combine this situation with the likelihood of suppressed bond returns in the years ahead, you can start to see why I believe strongly that a different approach to constructing and managing portfolios is so important to consider now.

For research and insight on these issues and more, click HERE.

'>That mediocre long-term return could destroy 60/40 portfolios in the years ahead.

My biggest pet peeve as a professional investor is watching “urban investment legends” develop over time, flourish, and then wreck the wealth of people who are lulled into complacency by them. One such legend is that the S&P 500 Index always produces excellent long-term returns. By extension, investment pros and media suggest that you put most of your money into un-hedged equity investments, with a lesser piece in bonds and cash, just to “balance” things somewhat. I think this is the great advice…for the advisor, not for the client. Yet 60/40 portfolios, index funds and the like are now dominant portions of investors’ long-term portfolios.

As with anything in investing, this might work out. But I don’t think it will. And there are 2 reasons for that. First, the bond portion of the plan is fraught with risks we have not seen in nearly 40 years, thanks to a bond bear market that is now over 2 years old. Second, the S&P 500 Index has just shown that when you truly look over longer time periods…20 years, let’s say… the impact of the occasional but inevitable bear market crushes your expectations. And all of this assumes that you don’t ding your return with emotional decisions along the way.

What do you think is the annualized return of the S&P 500 (including dividends) over the past 20 years? 8% 10%? 15%? Try 4.5%. Really. Here’s the chart.

But that’s not the biggest urban investment legend in this chart. Take a look across the entire chart, which is 20-year rolling returns going back to the early 1970s…which means it covers every 20-year period for the U.S. stock market going back to a start date of around 1950. That is plenty of evidence from which to draw a conclusion. And what I see is that for the vast majority of this long time period, the 20-year annualized return was under 8%. And as for the current level of 4.5%? It is at the low end of normal, which I would define as between 4% and 8%. That is certainly a decent return on your invested capital. But it is not anywhere near what many unsuspecting investors have built into their assumptions about their financial future. This is the complacency I referenced earlier.

This distortion between real and fake news, so to speak, is primarily because today’s wealthiest investors remember the 1980s and 1990s, which were a period of nearly uninterrupted strong returns for stocks. Indeed, for most of the 1990s and last decade, the 20-year S&P 500 return was over 8%, and for a while it was way over that level.

But today’s investment climate is different. We are 9 years into a bull market for this revered index, and even that has only lifted the 20-year return to 4.5%. That tells you that the preceding decade was a rough time. It also tells you to start thinking about how to reduce your risk of disappointment by thinking beyond the buy-and-hold index fund, particularly that which tracks the S&P 500. And when you combine this situation with the likelihood of suppressed bond returns in the years ahead, you can start to see why I believe strongly that a different approach to constructing and managing portfolios is so important to consider now.

For research and insight on these issues and more, clickHERE.

1suffix forming almost all Modern English plural nouns, gradually extended in Middle English from Old English -as, the nominative plural and accusative plural ending of certain 'strong' masculine nouns (cf. dæg 'day,' nominative/accusative plural dagas 'days'). The commonest Germanic declension, traceable back to the original PIE inflection system, it is also the source of the Dutch -s plurals and (by rhotacism) Scandinavian -r plurals (e.g. Swedish dagar).

Much more uniform today than originally; Old English also had a numerous category of 'weak' nouns that formed their plurals in -an, and other strong nouns that formed plurals with -u. Quirk and Wrenn, in their Old English grammar, estimate that 45 percent of the nouns a student will encounter will be masculine, nearly four-fifths of them with genitive singular -es and nominative/accusative plural in -as. Less than half, but still the largest chunk. Free full version of autocad 2010 download.

The triumphs of -'s possessives and -s plurals represent common patterns in language: using only a handful of suffixes to do many jobs (e.g. -ing), and the most common variant squeezing out the competition. To further muddy the waters, it's been extended in slang since 1936 to singulars (e.g. ducks, sweets, babes) as an affectionate or diminutive suffix.

Old English single-syllable collectives (sheep, folk) as well as weights, measures, and units of time did not use -s. The use of it in these cases began in Middle English, but the older custom is preserved in many traditional dialects (ten pound of butter; more than seven year ago; etc.).